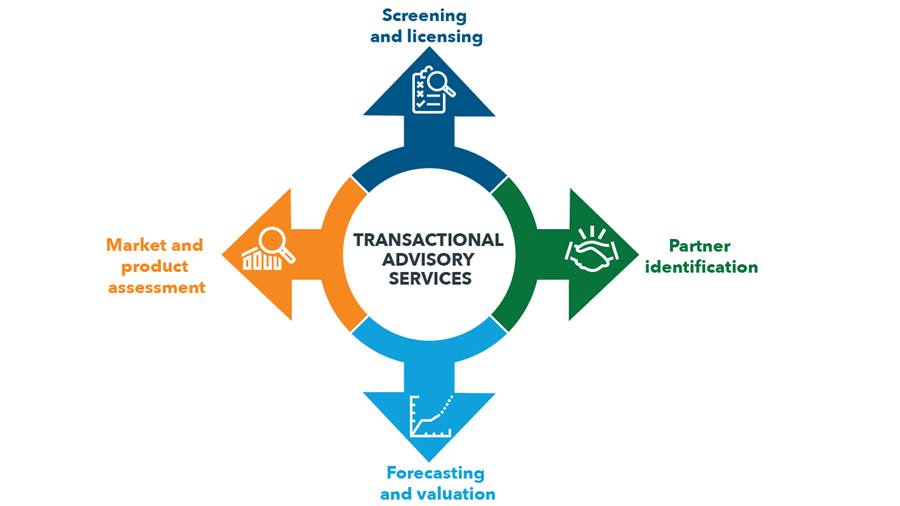

All about Transaction Advisory Services

Wiki Article

Rumored Buzz on Transaction Advisory Services

Table of ContentsThe Main Principles Of Transaction Advisory Services The Best Strategy To Use For Transaction Advisory ServicesThe Buzz on Transaction Advisory ServicesThe Best Strategy To Use For Transaction Advisory ServicesThe smart Trick of Transaction Advisory Services That Nobody is Discussing

This action makes certain the organization looks its best to potential buyers. Getting the company's worth right is essential for a successful sale.Deal consultants step in to aid by obtaining all the needed info arranged, responding to questions from buyers, and arranging check outs to the service's place. Purchase advisors utilize their expertise to assist organization owners handle tough arrangements, satisfy buyer assumptions, and structure bargains that match the owner's goals.

Meeting lawful guidelines is critical in any type of company sale. Transaction advisory services collaborate with lawful experts to produce and examine agreements, arrangements, and various other lawful documents. This lowers dangers and makes certain the sale adheres to the law. The role of deal experts extends beyond the sale. They aid entrepreneur in intending for their next actions, whether it's retirement, beginning a new endeavor, or handling their newly found riches.

Purchase advisors bring a wealth of experience and understanding, ensuring that every facet of the sale is taken care of professionally. Through calculated preparation, assessment, and settlement, TAS assists local business owner attain the greatest feasible price. By guaranteeing lawful and governing compliance and handling due diligence alongside various other offer team members, transaction experts reduce potential threats and obligations.

The 45-Second Trick For Transaction Advisory Services

By comparison, Big 4 TS teams: Work with (e.g., when a prospective customer is conducting due persistance, or when an offer is shutting and the buyer requires to integrate the business and re-value the vendor's Annual report). Are with costs that are not linked to the offer shutting efficiently. Gain costs per engagement somewhere in the, which is less than what investment financial institutions gain also on "tiny deals" (but the collection probability is likewise a lot higher).

, yet they'll focus more on accounting and evaluation and less on subjects like LBO modeling., and "accounting professional just" topics like test balances and just how to stroll via occasions using debits and credit ratings instead than economic declaration changes.

Our Transaction Advisory Services Diaries

Experts in the TS/ FDD teams might additionally speak with management concerning whatever above, and they'll create an in-depth have a peek here report with their searchings for at the end of the process., and the general shape looks like this: The entry-level function, where you do a lot of information and financial analysis (2 years for a promo from here). The following degree up; similar work, yet you get the even more intriguing bits (3 years for a promo).

Particularly, it's challenging to obtain promoted beyond the Supervisor degree since few people leave the work at that stage, and you require to start revealing evidence of your capability to generate earnings to breakthrough. Let's start with the hours and way of life since those are simpler to define:. There are periodic late nights and weekend work, however absolutely nothing like the agitated nature of financial investment banking.

There are cost-of-living modifications, so expect lower compensation if you remain in a cheaper area outside significant monetary centers. For all positions click now except Companion, the base pay consists of the mass of the overall payment; the year-end bonus offer could be a max of 30% of your base wage. Usually, the very best way to boost your profits is to switch to a various firm and discuss for a higher wage and bonus offer

The smart Trick of Transaction Advisory Services That Nobody is Discussing

You can enter into business growth, yet investment banking gets harder at this stage due to the fact that you'll be over-qualified for Expert functions. Business money is still an option. At this phase, you should just remain and make a run for a Partner-level role. If you wish to leave, perhaps transfer to a customer and do their evaluations and due diligence in-house.The major trouble is that because: You usually need to join another Big 4 team, such as audit, and job there for a couple of years and after that relocate right into TS, job there for a few years and afterwards move into IB. And there's still no warranty of winning this IB role since it relies on your region, clients, and the working with market at the time.

Longer-term, there is also some danger of and due to the fact that evaluating a business's historic economic details is not specifically rocket science. Yes, human beings will certainly always require to be included, but with advanced innovation, lower head counts might potentially support customer interactions. That stated, the Transaction Services team defeats audit in terms of pay, work, and pop over to these guys exit opportunities.

If you liked this short article, you may be interested in analysis.

Top Guidelines Of Transaction Advisory Services

Establish innovative economic frameworks that help in establishing the real market worth of a company. Offer advisory job in relationship to service assessment to help in bargaining and pricing frameworks. Clarify the most appropriate kind of the bargain and the type of consideration to employ (cash, supply, make out, and others).

Establish action plans for threat and direct exposure that have been identified. Perform assimilation preparation to establish the procedure, system, and organizational modifications that may be needed after the bargain. Make mathematical quotes of combination costs and advantages to examine the economic rationale of integration. Establish guidelines for integrating divisions, technologies, and business procedures.

Recognize potential reductions by decreasing DPO, DIO, and DSO. Assess the possible client base, market verticals, and sales cycle. Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance provides vital insights right into the performance of the company to be acquired worrying danger assessment and value production. Identify short-term alterations to funds, financial institutions, and systems.

Report this wiki page